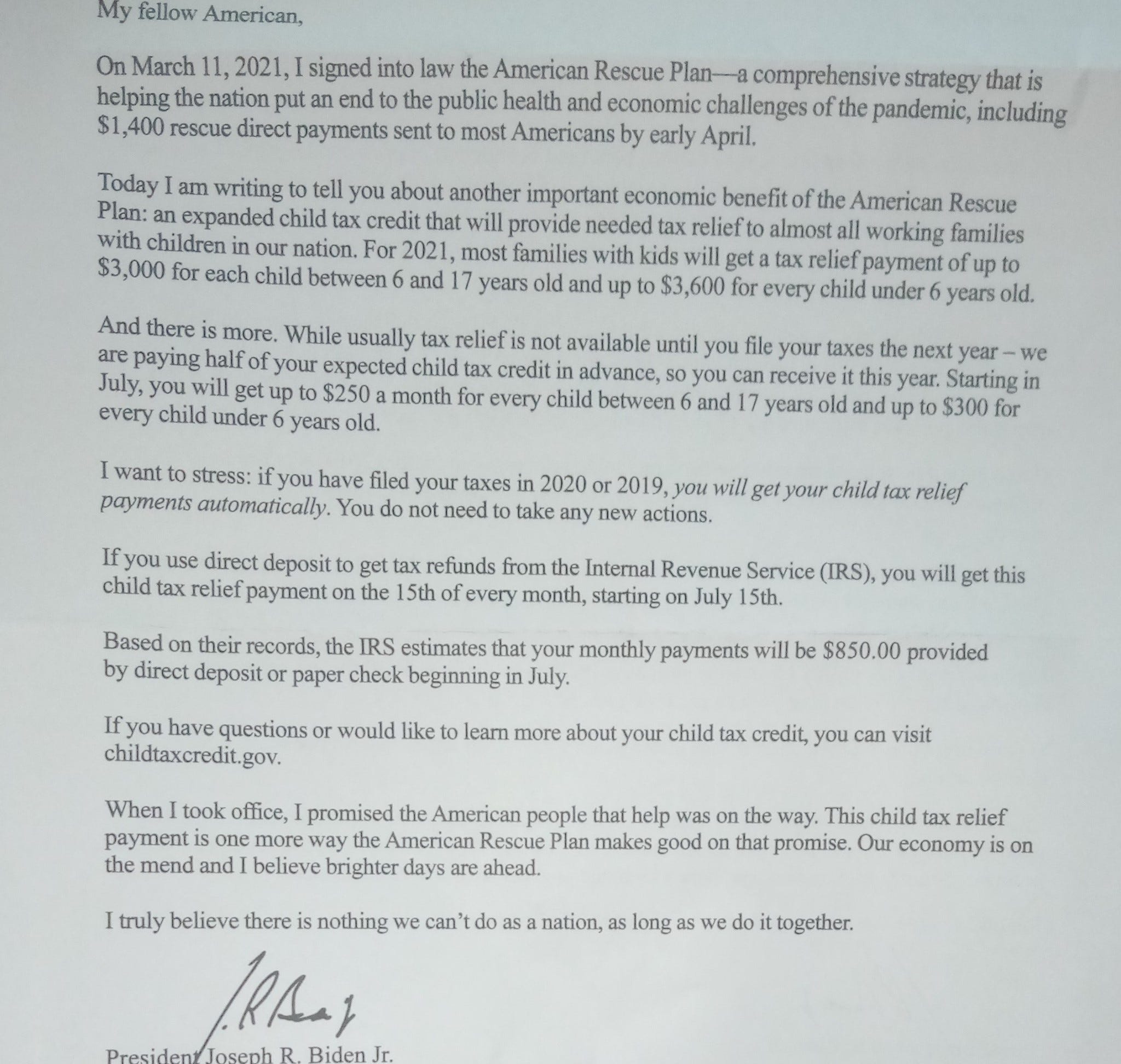

refund for unemployment taxes paid

The unemployment tax refund is only for those filing individually. You would be refunded the income taxes you paid on 10200.

Irs Unemployment Refunds Moneyunder30

These are called Federal Insurance.

. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. Federal law requires employers to withhold taxes from an employees earnings to fund the Social Security and Medicare programs. Local Property Tax Information.

By Anuradha Garg. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. If I paid taxes on unemployment benefits will I get a refund.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. 22 2022 Published 742 am. You want to claim a refund of any New York State New York City or Yonkers income taxes withheld from your pay.

So far the IRS has issued over 117 million refunds totaling 144 billion. ANCHOR payments will be paid. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Here is more information about unemployment tax. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable. Some will receive refunds while others will have the overpayment applied to taxes due or other debts.

The deadline for filing your ANCHOR benefit application is December 30 2022. You want to claim any of the refundable or carryover. We will begin paying ANCHOR benefits in the late Spring of 2023.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes. However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax.

Taxes - file pay inquire and order online. The tax rate for a start-up entrepreneur is 10 for the first year of liability 11 for the second year of liability and 12. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a.

10 200 Unemployment Refund When You Will Get It If You Filed Taxes Early

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What To Know About How Covid 19 Pandemic Changed Tax Laws

Unemployed Workers Could Get A Nasty Surprise At Tax Time

Irs Now Sending 10 200 Refund To Millions Who Paid Unemployment Taxes The Us Sun

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Are You Owed A Tax Refund For Unemployment Benefits Here S What You Need To Know Silive Com

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Unemployment Tax Refund Question R Irs

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

If I Paid Taxes On Unemployment Will I Get A Refund

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Here S Who Is About To Get A Surprise Refund From The Irs Averaging 1 265 Wkrc

California Unemployment Tax Refund R Irs

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Unemployment Tax Refund Problem When Will You Get Paid The National Interest

Can Your Unemployment Tax Refund Be Seized Yes For These Reasons Gobankingrates

Unemployment Tax Refund Taxpayers Frustrated By Irs Unresponsiveness